Although regulators have constantly slammed the cryptocurrency industry for its supposed role in funding illicit activities, the European Securities and Markets Authority (ESMA) has stepped forward to say that the DeFi market was not a threat to overall financial stability.

In an Oct. 11 report titled “Decentralized Finance in the EU: Developments and Risks,” ESMA argued that decentralized finance was yet to pose any meaningful risks to financial stability due to the size of the market.

Crypto-assets markets, including DeFi, do not represent meaningful risks to financial stability at this point, mainly because of their relatively small size and limited contagion channels between crypto and traditional financial markets.

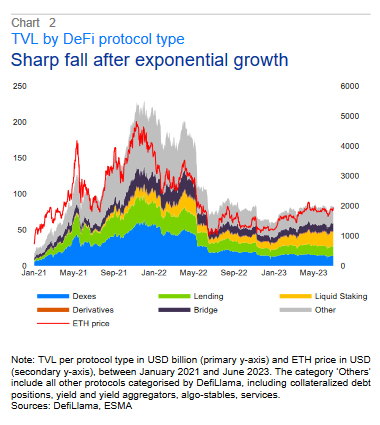

To put things in perspective, the market capitalization of the entire crypto market is around $1.05 trillion. And according to DeFiLlama, the total value locked (TVL) in DeFi is less than $40 billion. Comparatively, the total assets held in financial institutions within the EU was around $90 trillion as of 2021.

The report notes that the total crypto market is merely a fraction of the total assets held by EY banks. In particular, the entire crypto market is about the same size as the EU’s 12th largest bank.

But despite the current size of the market, ESMA explained that DeFi still featured some vulnerabilities similar to traditional finance and posed some serious risks to investors.

Because DeFi aims at replicating traditional financial services, it exposes users to the same types of risks, including market, liquidity, and counterparty risks. Market and liquidity risks are exacerbated with DeFi compared to traditional finance due to the highly speculative and hence volatile nature of many crypto-assets.

In the meantime, ESMA will continue to monitor the DeFi market and developments within the sector.